Investors and funders that don’t nurture capital, are wasting capital.

Mental ill-health and burnout in social change organizations and startups threaten their performance, social impact, and ultimately their survival. It also limits investors and funders ability to have positive impact on the world, as well as their ROI. We know this because companies with a healthy organizational culture deliver up to 3x the returns to shareholders as less healthy companies, and investing in impact yields higher returns.

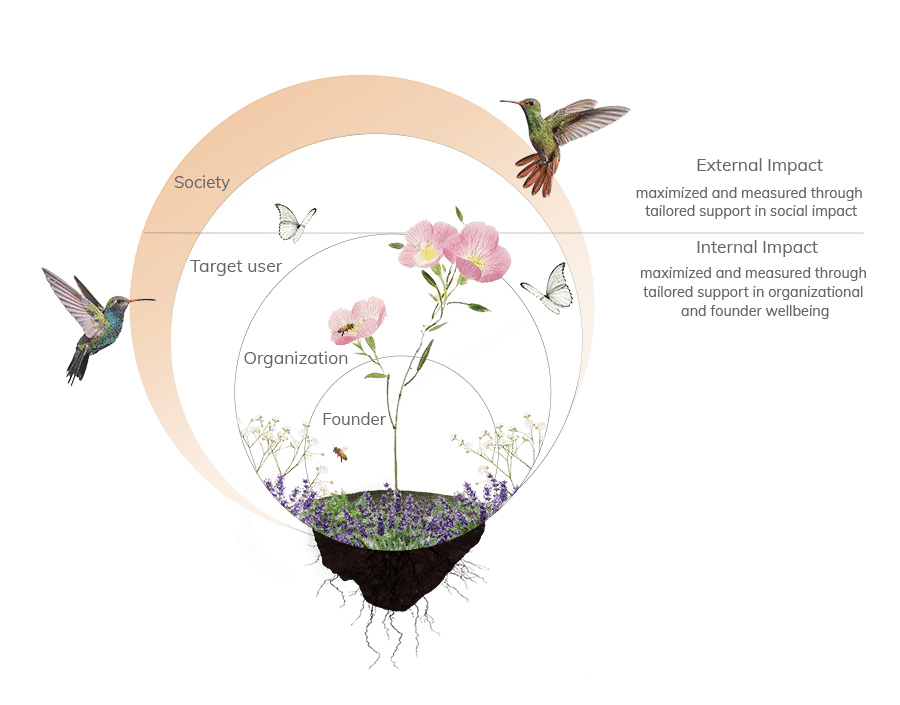

Nurture Capital is a unique investment approach created by Masawa. Central to Nurture Capital is the idea that when we support our investees and grantees in creating healthy organizational cultures conducive to human flourishing and help them maximize their social impact, we create a happier and healthier world and reduce write-offs and capital waste.